Members keep on reaping big as Yetu Sacco pays out highest dividends

This year has started well for members of Yetu Sacco who got paid lucrative dividends and interest on deposits, despite economic hardships occasioned by the disruptive post-election effects and Ukraine war.

The gigantic Sacco 32nd Annual General Meeting held on Jan 26, marked the end of an eventful year 2023 and the beginning of a promising 2024.

It was a milestone year for the Sacco as it was dominated by member centered events such as: the launching of two new branches in Chuka and Kitengela, a successful and extensive member education, ground breaking of their signature Headquarters building and regular member engagements in different forums including a special AGM held on December 1st.

This remarkable achievement is a testament to the Sacco’s commitment to expanding its services to its members and providing for all their banking needs.

The Sacco witnessed key growth with a 28% membership growth- from 66,084 to 84,075 in the 2023 financial year.

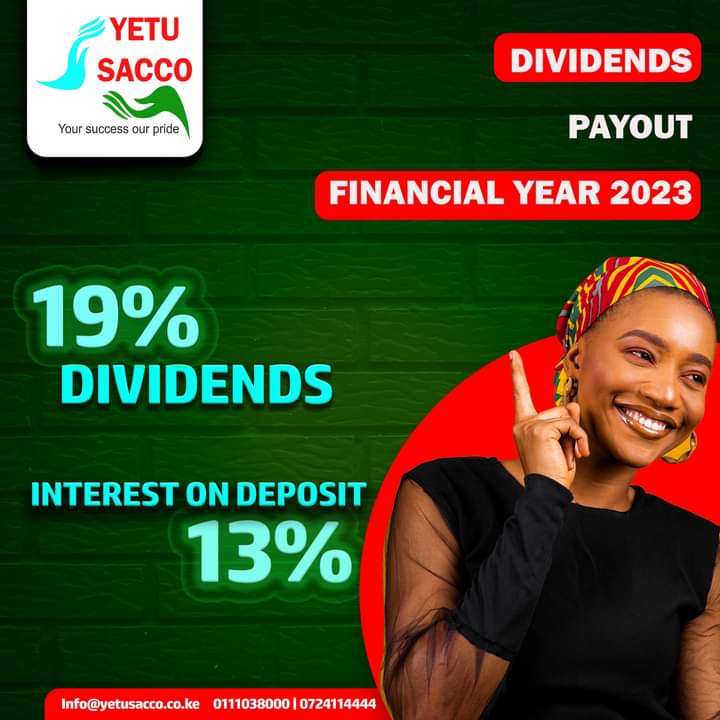

Members of Yetu Sacco earned mouthwatering percentages from a whooping Sh350 million that was announced in form of dividends and interest on their deposits. The members were full of joy as the Sacco announced a dividend payout on share capital at a rate of 19 percent and 13% Interest on deposits.

Yetu Sacco will be aiming to further enhance its value proposition by marking a new chapter in its journey towards achieving its mission and strategic objectives by actualizing the formation and launching of “Yetu Foundation” by April 2024, that will be the vehicle to executing all its CSR projects in their communities.

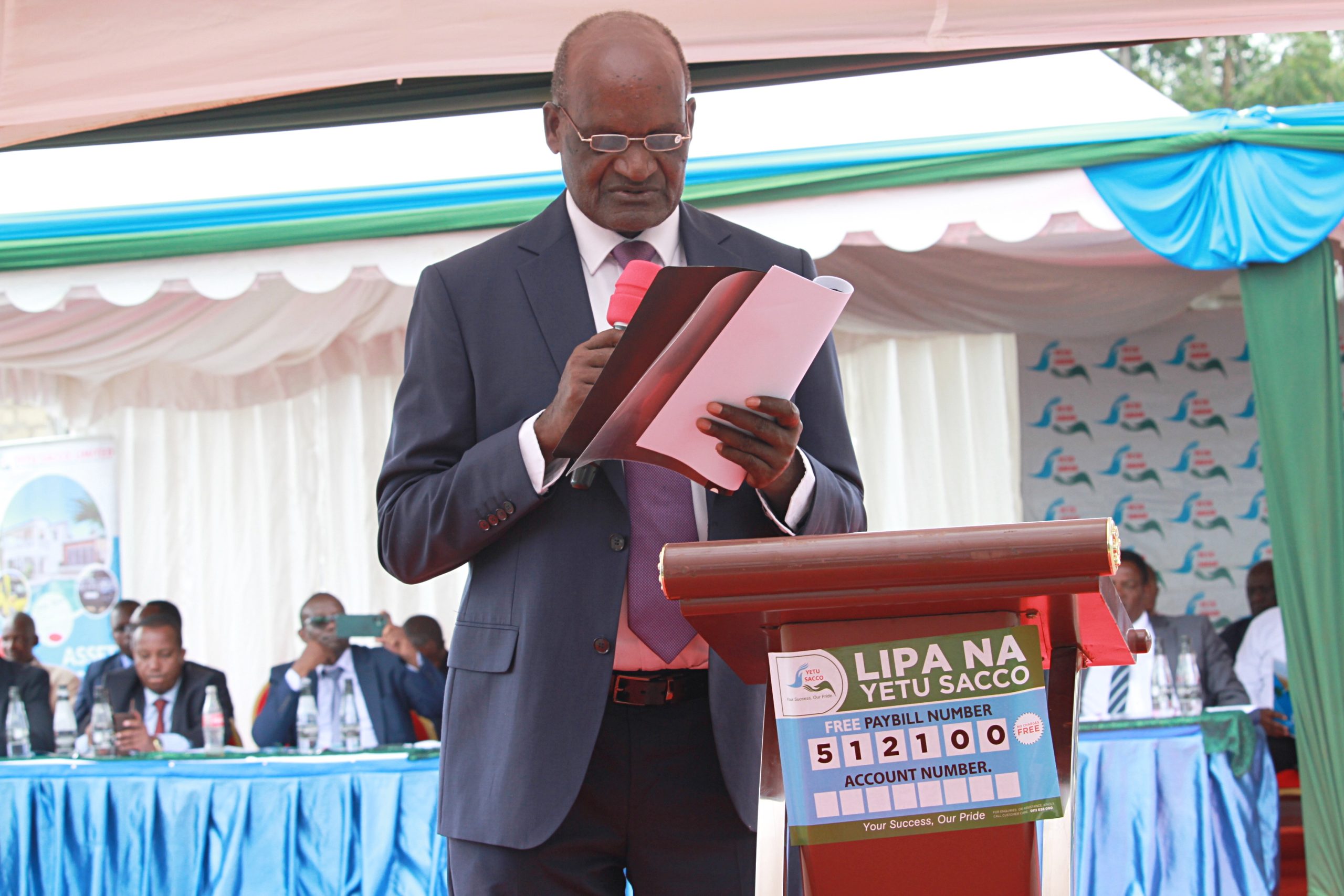

The Sacco Chairman Mr Mark Gitonga, during his speech, expressed his gratitude for the unwavering support and commitment of its members, for their patronage to the Sacco services and products and their resilience in upholding the Sacco’s value and principles.

Mr Gitonga emphasized that the Sacco’s success is evidence to the dedication and commitment of its members and promised to continue delivering excellent services that meet their evolving financial needs.

The Chairman further noted that the Sacco is constructing an iconic headquarters office in a bid to create adequate office spaces and banking hall.

“The building is being built by the savings we have put aside over the last five years; hence we are not borrowing. The building shall be iconic and its one of a kind with an underground parking. This will go a long way in improving our image and providing ample and adequate offices to serve our members better.” Mr Gitonga said

While the Sacco’s revenue grew by 16.5% from Sh789,154,498 to Sh919,904,458, the share capital also rose by 36.5% to Sh254,724,522 as compared to Sh186,082,159 in 2022.

Loans to members saw a growth of 20.8% from Shs.3,312,272,534 in to Sh4,004,049,151 in 2023 with member deposits growing by 25%.

Yetu Sacco 2023 Performance Highlights

| Key indicators | 2023 | 2022 | Growth % |

| Membership | 84,075 | 66,084 | 28% |

| Loan to members | 4,004,049,151 | 3,312,272,534 | 20.8% |

| Member deposits | 4,050,437,816 | 3,238,451,047 | 25% |

| Share Capital | 254,724,522 | 186,082,159 | 36.5% |

| Revenue | 919,904,458 | 789,154,498 | 16.5% |

| Reserves | 304,228,479 | 274,154,923 | 10% |

| Total Assets | Sh6,419,127,363 | Sh5,367,548,160 | 19.8% |

Additionally, the Sacco through an investment company registered under Co-operative Act owns various flagship project including a eight-storey building in Nkubu that host Yetu DT Sacco owned-Pamoja Technical Training Institute.

According to Pamoja Investment Chairman Mr. Patrick Rutere, the Society through the Pamoja Training Institute has offered full sponsorship to fifteen students undertaking various courses.

The tertiary institution offers various technical courses such as catering, IT, engineering, building technology, agriculture courses, banking, architectural among other many exceptional courses.

Mr Rutere also invited members to pay a visit to the institution, which has seen enormous growth in number of students registering over the months since its establishment in 2023.

He called for the members to support the institution as it continues to offer the best education services at pocket friendly fees for diploma and certificate courses, which are the pillar to any economy.

The chairman Supervisory Committee CPA Murithi Nkungi, commended and board members and management on the strategic and operational management of the Sacco.

Nkungi reported that the supervisory committee was satisfied with the management and performance of the Sacco for the year just ended 2023.

“We will continue to discharge our mandate by both challenging the Board and Management to dream bigger, while at the same time overseeing prudence in the application of the Sacco’s resources for the benefit of our members.

Once again, let me urge each one of us to personalize the success of our Sacco by ensuring that the benefits of its success are felt in our pockets. Let us grow our share capital.

Let us increase our member deposits. Let us patronize the Sacco products, which are by far the best prices in the market. Let us faithfully repay our loans to avoid inconvenience. And let us love our neighbors as we love ourselves by continuing to introduce them to our Sacco, and draw them from the harmful financial products they are consuming elsewhere,” said Mr Nkungi.

Gracing the event as chief guest, the Director Co-operatives Banking Division at the Co-operative Bank, Mr Vincent Marangu applauded Yetu Sacco for its huge achievement, stating that, “Yetu Sacco is a very strong Sacco and we have continued to partner with them. If you want to grow, join Yetu Sacco”.

The Sacco CEO, CPA Dennis Kirimi, reported an impressive performance in the year ended 2023.

Additionally, Mr Kirimi said that Yetu Sacco will be stepping up the implementation of their digital strategy by finalizing on the digitalization of its registry, improve digital loans, establishment of a customer experience center and other digital platforms in line with giving its members a more efficient experience and services.

The CEO also reported that through their free paybill (512100), they were able to mobilize deposits of over Sh6.0 billion with their dedicated savings officers collecting over Sh812 million.

“Our brand Yetu Sacco that has become a big trade mark in the financial sector, contributed in a big way towards the solid financial performance indicated above,” said Mr Kirimi

“We will lead by example as a corporate entity, in the way we treat our people, champion human rights and diversity and inclusion. Yetu Sacco will also continue its mandate of social engagement in the communities where we operate. Our sustainability governance shall be underpinned by a comprehensive framework, based on integrity and transparency.” he noted

Mr Kirimi added that value creation for Yetu Sacco shareholders is vital to growing a sustainable, well managed institution.