Why Yetu Sacco is the best avenue to make savings

The giant Yetu Sacco undisputedly remains to be the most viable Sacco to join in 2023.

The acclaimed Sacco has set the pace on multiple fronts, by rewarding its members with mouthwatering dividends, unmatched savings, and credit products.

Yetu Sacco has also been embracing in full throttle the significance of the 5th Co-operatives Principle on Education, Training, and Information; which emphasizes the importance of member education, in acknowledgment that an enlightened member is a better investor.

The distinguished Sacco has attracted praise not only from its members but also from regulators and onlookers without failing to mention the Cooperatives Cabinet Secretary Simon Chelugui who lauded the Sacco for its upwards trajectory.

According to Yetu Sacco Chairman Mark Gitonga, the fast-growing Sacco sailed through economically challenging years to post impressive financial results for the year ended December 31, 2022.

On the back of a precarious electioneering period that ensued after the ravaging Covid-19 pandemic, the SACCO enriched its members’ pockets with Sh 290 million dividend and interests in 2022 up from Sh 240 million in 2021.

Yetu Sacco paid the dividends on share capital at 18 percent and interest on members’ deposits at the rate of 13 percent for the year ended December 2022.

The Sacco’s total assets grew from Sh4.7 billion in 2021 to Sh5.37 billion in 2022, elevating the Sacco to tier-one status.

Tier one status is enjoyed by Saccos with assets totaling more than Sh5 billion.

The Sacco revenues also grew by 13.6% an aspect that the Sacco treasurer Mr Paul Mwiti says shows the members’ money is being invested well.

Yetu Sacco has also managed to grow its investment income to Sh 137 million as of 31st December 2022.

The famous growing Sacco has also managed to diversify its income sources by investing excess liquidity of 46% in 2022 breaking the record and exceeding the regulators’ requirement of 15%.

Yetu Sacco’s affordable and easily accessible loans and products have over the years gained popularity and attracted Kenyans keen on saving for the future. According to the Sacco, an increase in lending by 10.5% and a growth of members’ deposits at the rate of 13.6% was reported by the end of the year 2022. This was followed by the registration of 6,743 new members and an increase in staff.

Speaking during Yetu Sacco’s annual general meeting, the chairman Mr Gitonga noted that the Sacco made an upward trajectory due to measures put in place to shield the Sacco from Covid-19 ravages and the election period.

“Due to measures put in place to shield the Sacco from Covid-19 ravages followed by the national campaign period, we were able to comfortably lend but in a regulated fashion aimed at guarding the Sacco against possible losses during the harsh period,” the Sacco Chairperson noted.

Strict adherence to the governance structure backed by a robust strategic plan and good management has seen Yetu Sacco grow from strength to strength.

“Yetu Sacco is guided by principles of corporate governance that have given us a great environment to prudently manage the members’ funds while maximizing their wealth,” Mr Gitonga added.

The gigantic Sacco also boasts of transitioning to digitalization paving the way for use of technology in offering services to members.

Yetu Sacco CEO Dennis Kirimi credits the Sacco success to the professionalism and dedication of its highly trained staff.

Mr Kirimi also attributed the growth of Yetu Sacco to the ability of its users to access all services through the Yetu-Cash App from the comfort of their homes.

The celebrated Sacco also prides itself on having a very interactive member portal, hence digitalizing almost all its processes.

“Member experience is the new gold. The greatest value you can add is to improve member ability to engage the Sacco with ease. Customer service is one of our key focuses, our members have been able to access services through our customer relations platform as well as an interactive website,” Mr Kirimi noted.

The indomitable Sacco is also famous for launching a free Paybill platform dubbed ‘Lipa Na Yetu’ which enables members to save through the Paybill number 512100 without being charged.

Yetu Sacco also migrated to the enhanced *691# USSD banking code, launched both the android and IOS Apps hence optimizing the delivery of services where members will be able to efficiently check balances, withdraw to mobile money accounts and conduct transfer funds or deposit among other services.

The Sacco also has adopted Microsoft 365 for emailing, an addition that the Sacco CEO says has enhanced effective and efficient collaboration among the staff members in executing their service delivery mandate.

Yetu Sacco has also widened its reach by opening 58 agency outlets across its operating Counties.

The Sacco, which currently has over 65,000 members has seven outlets which include the newly opened Kitengela branch and Chuka branch that is expected to be opened soon.

Other outlets include Nkubu Branch, Nairobi Branch, Meru Branch, Kionyo, and Kinoro Branches.

According to Mr Kirimi, Yetu Sacco has expanded and refurbished its Nairobi branch giving it a corporate look as well as relocating the Meru Branch to a more strategic location from Kirikuri road to Njuri Ncheke Street (housed at Sawasawa Uniform Building).

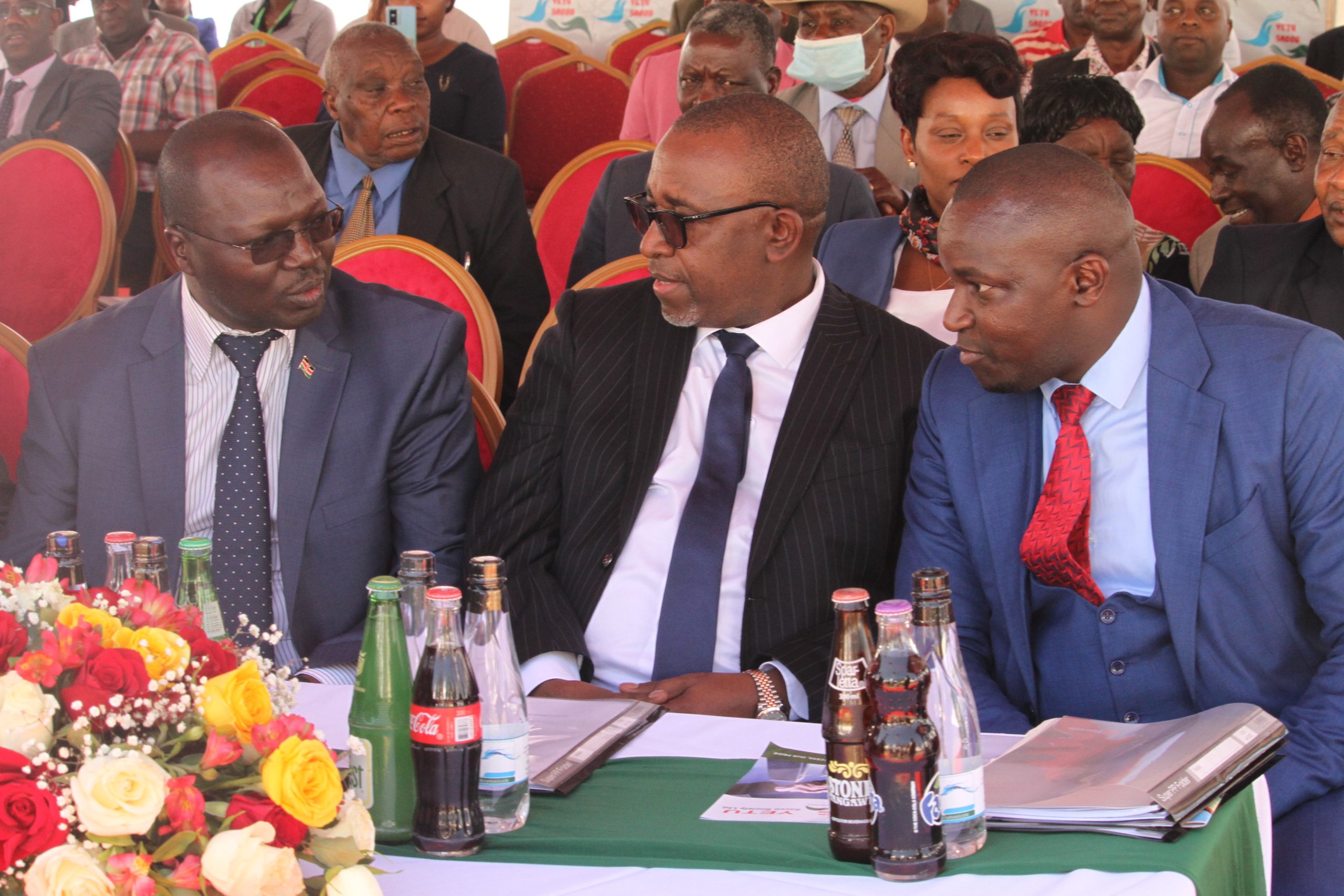

Speaking during the Annual General Meeting various guest speakers led by Cooperatives Cabinet Secretary Simon Chelugui and Agriculture CS Mithika Linturi, lauded the Sacco management for implementing effective measures meant to increase more savings from members; which has boosted the asset base.